How Do I Reconcile a Disbursement?

From the Payments Portal, you can compare a total withdrawal amount against incoming transactions to reconcile each withdrawal total within your bank account.

On This Page

Creating a Report from the Payouts Page

Creating a Report from the Reports Page

Frequently Asked Questions

From the Payouts Page

- Click the Reports tab from the "Admin" section of the left-hand navigation menu.

- Scroll to the Payout History section and click on Payout Details to view a breakdown of the Payout information.

-

Reconciliation details can be reviewed here and downloaded here.

-

Each of these disbursement totals will be reflected across 4 columns that show Transaction Count, Credit, Debit, and the Amount Disbursed.

-

Disbursement Details Definitions:

- Sales - Reflects the total dollar amount of the Merchant's sales transactions during the selected date range.

- Refunds - Shows the total dollar amount of transactions that have been refunded by the Merchant.

- Fees -Shows the total dollar amount of fees that have been charged to the Merchant's transactions within the chosen date range.

- Debits - This section shows the total dollar amount of any previous debits that have been issued on the Merchant's account and are now being deducted from the current disbursement.

- Chargebacks - Shows the total dollar amount that has charged back to the merchant before the withdrawal is disbursed.

- Rollovers - Reflects the total dollar amount that has charged back to the merchant before the withdrawal is disbursed.

- Not Disbursed - This section shows the total dollar amount that was not paid out for various reasons.

- Withdrawal Failures - Represents withdrawal requests that were not successful and did not go through.

From the Reports Page

- Click the Reports tab from the "Admin" section of the left-hand navigation menu.

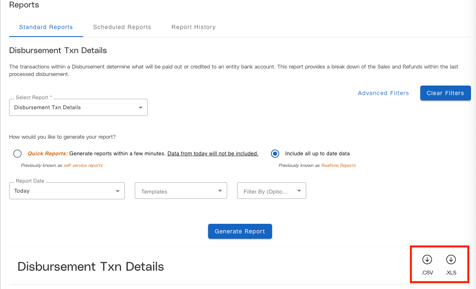

- Under the Standard Reports tab, run a Disbursement Txn Details Report under the "Select Report" dropdown.

- Select a report option (Quick Report or Include all up to date data) and select the date range, filters, and templates you would like to apply.

- Select the blue Generate Report button to generate your report.

- If you generate a Quick Report, it will create a report that will show in the Report History tab in a few minutes.

- For Include all up to date data, it will populate on the bottom half of the page within a few minutes.

- If you wish to download a copy of your report:

- To download a Quick Report, click on the Report History tab, then select the three dots next to the report you want to export and select Download.

- If you would like to download a copy of the Include all up to date data report, select the .CSV or .XLS button on the top of the Report details.

- To download a Quick Report, click on the Report History tab, then select the three dots next to the report you want to export and select Download.

FAQ

- Does the dollar amount affect the time it takes to settle and disburse a transaction?

- Refer to this article to view processing times.

- Why did my disbursement fail/not go out?

- Contact JobNimbus Technical Support for assistance.

- Why would my Disbursement Summary Total not match my Transaction Totals?

- Disbursements may appear to be off in lower decimal places upon first glance. If you download the "Disbursement Txn Report" in XLS/CSV format under the Reports tab, you’ll be able to see the accurate reporting information for reconciliation. The reason you may not be able to see these decimal variances upon first glance is because they’re (typically) caused by rollovers (remainders), reserves, adjustments, and fee refunds.

- What is a rollover?

- A rollover (or remainder) is an account balance with a value that is < one penny.

- Example: $0.005

- Rollovers can be present even if a balance is greater than one penny in total.

- Example: $100.005 = one hundred dollars with a halfpenny [$0.005] rollover

- A rollover (or remainder) is an account balance with a value that is < one penny.

- Why do rollovers happen?

- Because fees are assessed as less than a penny is represented, but not disbursed until another rollover can bring the total balance to a full penny.

- The most common reason a rollover will happen is a fee being charged to a Merchant for access to the Referrer’s platform may result in fractions of or less than one penny, which cannot be represented in a traditional currency format, but will reflect in your Disbursement Txn Details Report.

- Because fees are assessed as less than a penny is represented, but not disbursed until another rollover can bring the total balance to a full penny.

- What is an adjustment?

- An adjustment refers to the process of moving funds from one entity account to another. Adjustments appear as fee credits or debits under the Disbursement Details section of "Withdrawal Transactions".

- Why do adjustments happen?

- Adjustments happen when a Merchant receives a miscellaneous refund from the Referrer and there is no correlated fee to charge the refund against. This adjustment will come from the Referrer-level Entity and be present in the Merchant's Disbursement Txn Report.

- What is a fee refund?

- A fee refund refers to the process of a Referrer refunding the cost of a fee to a Merchant. They may appear as fee credits under the Disbursement Details section of "Withdrawal Transactions".

- Why do fee refunds happen?

-

Fee refunds happen when a Merchant fee is charged by the Referrer but now needs to be processed as a refund to the Merchant at a later time due to a dispute, or other related fee issues.

-

Fee refunds only differ from adjustments in that they are categorized and systematically connected to a fee transaction that takes place between the Merchant and Referrer. In most cases, a fee refund should not cause a disbursement reconciliation discrepancy.

- Note: There are rare exceptions, such as processing a fee refund on a Friday evening. This transaction might appear on the Disbursement Txn Report if the report was pulled that Friday evening, but not actually reflect against your Transaction Totals, as the fee hasn't been processed from the weekend until the following Monday. This timing leaves potential room for a discrepancy based on the timing of the actual fee refund being received versus the final amount shown in the Disbursement Txn Report before the next business day.

-