QuickBooks Desktop Error - Taxes Are Being Modified When Syncing to QuickBooks

Explanation: Regardless of the tax rate chosen on an invoice in JobNimbus, QuickBooks will override it based on the tax settings within your QuickBooks account.

This information applies to the U.S. versions of QuickBooks only.

There are several places to check in QuickBooks if your tax rates are being updated on records as they sync:

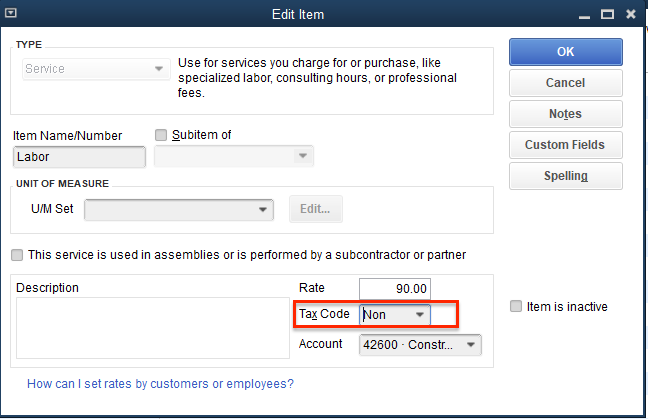

- On the item in the item list

- If an item that is added to an invoice is assigned a "non" tax code within its settings, then any tax rate associated on the invoice in JobNimbus will be removed:

- If a product is used in JobNimbus and assigned "none" as a tax, but is assigned as "taxed" in QuickBooks, then QuickBooks will change that line and tax it as the invoice imports into JobNimbus.

- Marked as Tax Exempt in JobNimbus:

- Item will show as taxable in QuickBooks:

- QuickBooks imports the line with a tax rate and changes the total amount accordingly:

- Marked as Tax Exempt in JobNimbus:

- If an item that is added to an invoice is assigned a "non" tax code within its settings, then any tax rate associated on the invoice in JobNimbus will be removed:

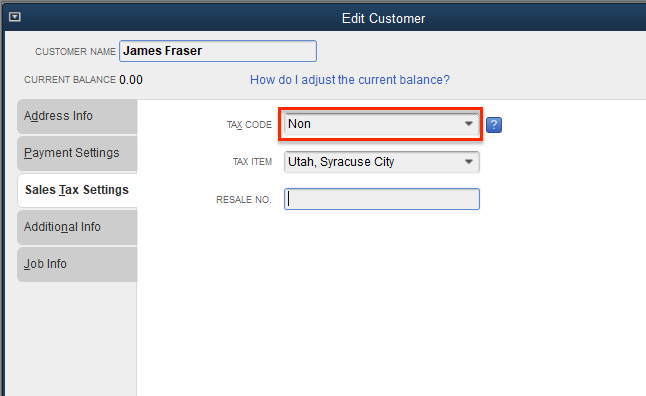

- Tax settings on the Customer

- Each Customer in QuickBooks is assigned a tax code. If that tax code is listed as ‘non’, then invoices sent to that customer will have the taxes removed by QuickBooks:

- Please note: A customer that has synced from JobNimbus will be automatically assigned the tax code ‘Tax’, according to your Company Sales Tax Preferences found in your QuickBooks account > Edit > Preferences > Sales Tax > Company Preferences.

- Each Customer in QuickBooks is assigned a tax code. If that tax code is listed as ‘non’, then invoices sent to that customer will have the taxes removed by QuickBooks: