How Do I Reconcile Processing Fees in QuickBooks When Using JobNimbus Payments?

To account for JobNimbus Payment fees when reconciling your bank account, you will need to add them as an expense when depositing the payment.

The full payment amount will be entered into QuickBooks as a Payment, either manually or through the QuickBooks sync.

A payment entered from JobNimbus will be sent to your Undeposited Funds account in QuickBooks.

Accounting for Credit Card fees in QuickBooks

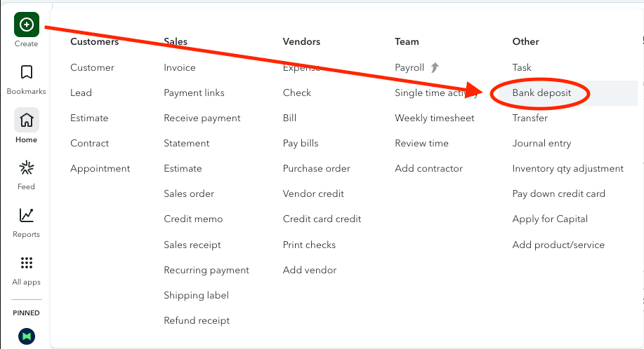

QuickBooks Online

- Click on + Create and then Bank deposit

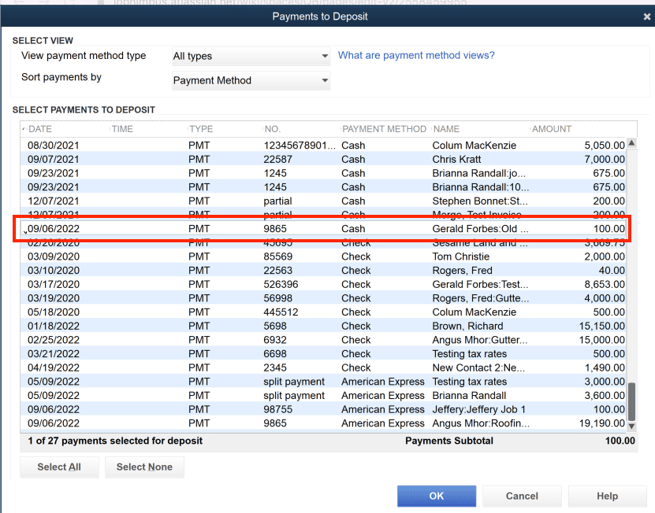

- Click on the payment(s) being deposited

- At the bottom of the Bank Deposit screen, enter an expense account and a negative amount for the credit card fee.

- Save the deposit. The total amount of the deposit will be the total payment amount minus the credit card fee and can now be matched with your bank feed.