QuickBooks Online Error - Taxes Are Being Modified When Syncing to QuickBooks

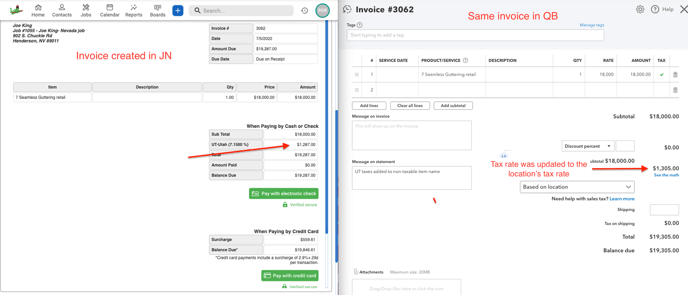

Explanation: Regardless of the tax rate chosen on an invoice in JobNimbus, QuickBooks will override it based on the tax settings within your QuickBooks account.

This information applies to the U.S. versions of QuickBooks only.

Invoices are being assigned a tax rate based on the address

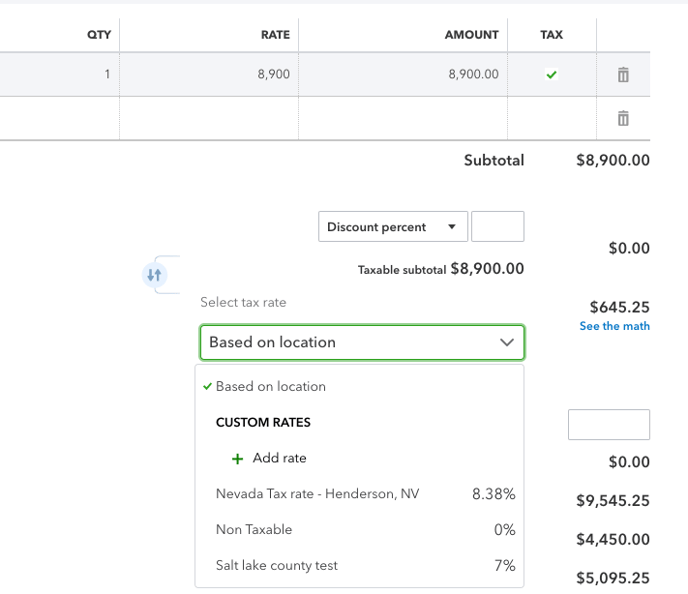

- QuickBooks uses an automated system that will assign tax rates to new invoices ‘based on location’ by default, meaning it will use the tax rate associated with the address of the customer.

- JobNimbus is not able to override this action. If you need a tax rate assigned to an invoice that is different from the company’s address, you will need to create the invoice in QuickBooks and change the tax rate manually before saving.

- Example of taxes on the invoice being changed:

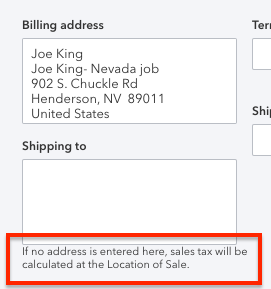

- If there is no address listed in the "shipping to" field on the contact or job in QuickBooks, then it will default back to the location of the company:

- The "shipping to" address field does not sync with JobNimbus, so customers and jobs created by the sync will not have any "ship to" data.

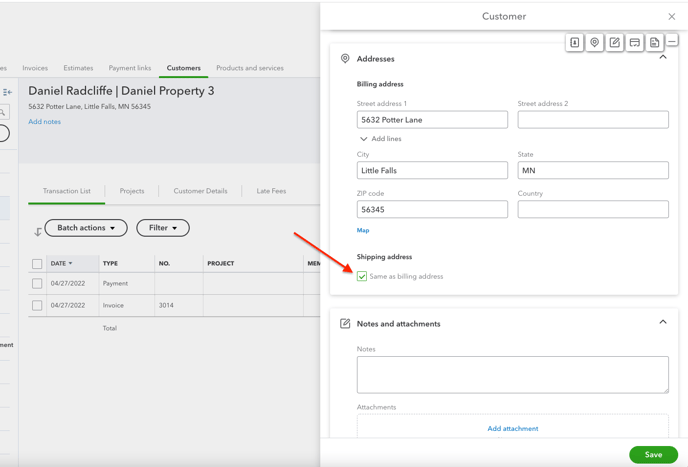

- To input an address, you must edit the customer or job in QuickBooks, add the details to the field (when you open the edit screen, the box next to ‘same as billing address’ will be checked by default), then click Save.

- To input an address, you must edit the customer or job in QuickBooks, add the details to the field (when you open the edit screen, the box next to ‘same as billing address’ will be checked by default), then click Save.